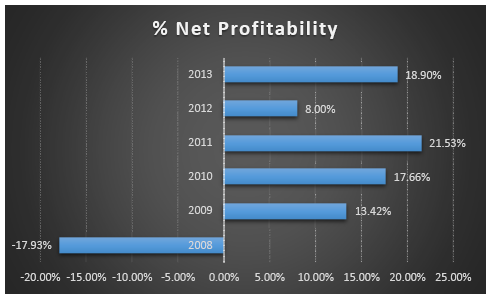

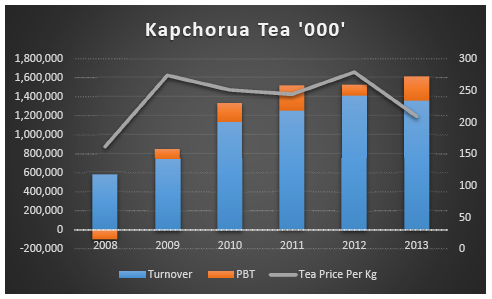

Listed tea company, Kapchorua Tea posted an 18.9% jump in profitability in 2013 to stand at KES 180 million from KES 78 million. Sales dropped marginally to KES 1.35 billion from KES 1.4 billion due to declining tea prices and increasing production in the period. Its stock price has held firm, up 28% year-to-date and 132% since 2008.

Continued investments in plant and machinery has helped improve its operational efficiencies. As a result, profits arising from operating activities jumped a whopping 66% to KES 122 million in 2013. The tea firm invested over KES 110 million in new plant and machineries in the last two years. Profits arising from changes in fair value of biological assets rose to KES 57 million from KES 4 million.

With reserves of over KES 1 billion, the company can withstand any price shocks or any losses arising from a poor season. Cash at hand is at KES 128 million that brings it to KES 32.9 per share. EPS is at KES 45.94. What’s also admirable about the company is that interest received from interest-bearing investments more than covers their interest payable meaning a large portion of their cash flow goes is left untouched. Its unsurprising therefore that its revenues reserves stand a tad higher than a KES 1 billion.

Projected rainfall for the March-May 2014 ‘long rains’ season over the central and north-western counties is expected to increase according to Kenya Meteorological Service. This will go a long way in shoring up its production hence expectations for a bumper harvest in the next six months are valid.

CHALLENGES

- The Ad valorem tax charged on Kenya’s tea is high, making tea less competitive in the market. Coupled with the 16% VAT tax on local sales, doing business becomes challenging. Ad valorem tax is currently set at 1% of the total custom value of the tea exported;

- High production costs;

- Unreliable rainfall hurting production – Depressed and poorly distributed rainfall recorded over the October-November-December 2013 ‘Short Rains’ season affected production for the full year 2013;

- Depressed demand from the global market;

- Increased production dampening prices – As at the end of last year, total tea production in the country stood at 432 million kilograms, up 25% from 345 million kilograms in 2009. As a result, tea prices are down nearly 23.6% from their five year highs due to increased supply. A kilo of made tea currently is selling at an average of KES 205.03 down from KES 270 in 2009;

- Fluctuating currency rates.

OUTLOOK

Challenges notwithstanding, the following factors should help buoy its price in the long run.

- Increasing stability of Egypt – the country buys 20% of Kenya’s tea;

- Stockpiling from Afghanistan (another major buyer) due to national elections to be held in April 2014;

- Lower operational expenses-cutting pay-outs to its small scale out growers;

- The introduction of the Agriculture, Fisheries and Food authority may help engage with the government in order to address issues affecting the industry.

Despite being largely under covered by investment analysts, Kapchorua Tea has returned an average of 10.6% in the last six years comparing to a dismal -2.5% return by the NSE 20 Share Index in the same period. The current market price at KES 150 (As at 12th march 2014) is 1.5 times lower than its Net Asset Value while its PE Ratio stands at 3.27. This means bargain hunters are looking at a good valuation opportunity.

With only 3.9 million shares issued (one of the least after Limuru Tea ), only investors with a long term investment horizon form a perfect fit for this type of stock. As the global economy recovers, the long term recovery in world commodity prices is expected hence Kapchorua Tea stands to benefit.