In the statement issued by the Monetary Policy Commitee (MPC) following their meeting, the committee noted that “the market had confused the role of the CBK Overnight Window rate as a signal of monetary policy”. Further it was clarified that the “Overnight Window Rate” was in fact an outcome of the CBR, a penalty, and a measure of market tightness”.

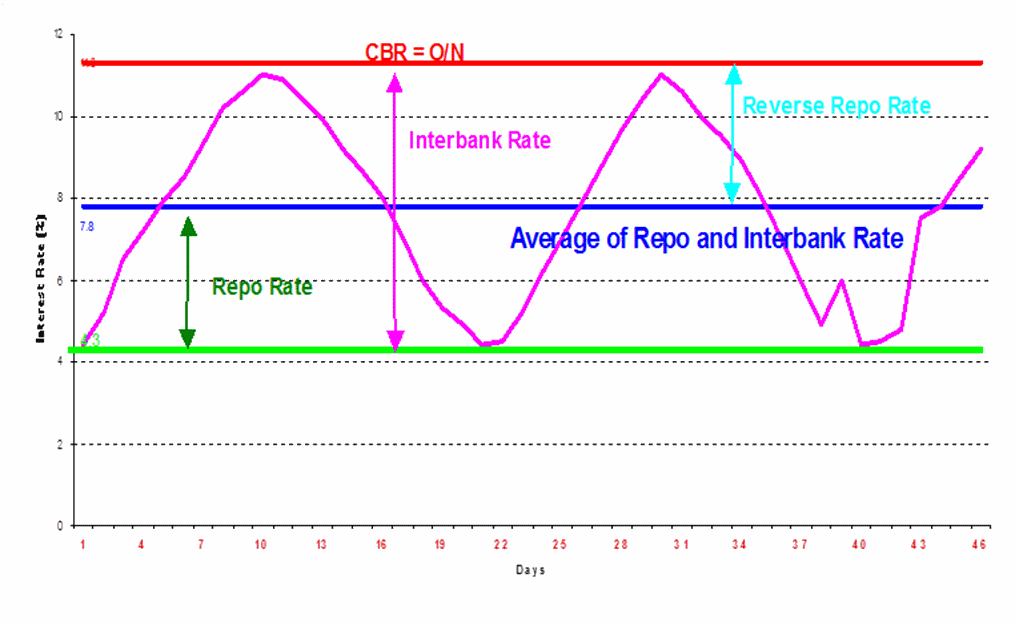

At the time when the CBR was introduced in 2006, the CBK had explained the purposes of the CBR. This was explained in the chart below:

[Source: CBK presentation on Central Bank Rate – 7th June 2006]

[Source: CBK presentation on Central Bank Rate – 7th June 2006]

The CBK had further clarified at the time of the introduction of the CBR that “The CBR is the Overnight Window Rate”. Further, since its introduction until August 2011, the CBR has operated as the Overnight Window Rate. Therefore, we do not believe that there was any misinterpretation by the market in the role of the Overnight Window Rate, since the two have been identical on a policy basis. The link between these two rates has been broken, on an ad-hoc basis only in August 2011 and on a policy basis by the MPC on 14th September 2011.

Without announcing the specific margin between the CBR and the Overnight Rate, the overnight rate now stands at 10%. This translates to a margin of 3.00% over the CBR. In effect therefore the Overnight Rate of the CBK has increased since the beginning of the year from 6% to 10%, even though the CBR has risen only from 6% to 7%, and the increase from the previous meeting of the MPC is 375 basis points.

Most analysts, including ourselves, have called the increase in the CBR by 75 basis points as too little. We are now revising/ modifying our opinion to state that the increase in the CBK Overnight Rate is extremely aggressive, mainly attributable to the implementation being delayed too long rather than being phased in since the beginning of the year. With such an aggressive move on the interest rate front, there may not be a need for any further increases in the policy rates till the end of this year.

The full impact of the increase has not been absorbed by the market as yet for three reasons:

- The extent of the increase has not been explicitly spelt out, and only a 75 basis point increase in the CBR has been announced.

- The actions of CBK in between the meetings pushed up the overnight rate from 6.25% to 30% over the period 12th August to 26th August. In relation to 30%, the current rate of 10% is substantially lower.

- Market liquidity has improved following the change in the method of maintaining the Cash Ratio from a daily basis to a monthly basis, as well as due to banks having a strong preference for cash, and not rolling over their maturing investments in government securities. Therefore the borrowing at the Overnight window rate has been minimal since the announcement of the policy changes.

Our view is that and the CBK need to return to a consistent, stable and predictable path of monetary policy based on clearly stated objectives and linked to clearly specified and measured targets. Further, the policy needs to operate on a pre-emptive basis rather than a reactive basis, so that inflation remains within the set targets, and not for corrective action to be initiated only after inflation has exceeded the target rate. Once this is seen to be in place, risk premiums in market interest rates will narrow and we will see a fall in interest rates across the yield spectrum.