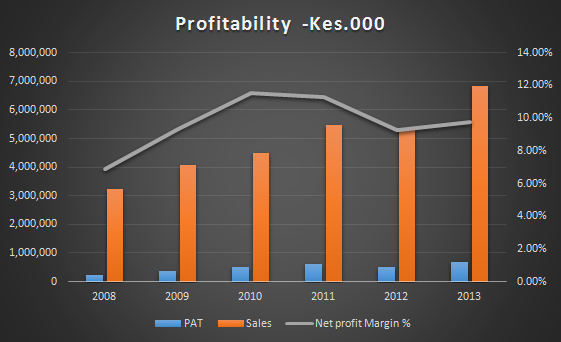

TPS Eastern Africa Limited posted its group results for the year ending 31st December 2013 which showed a remarkable improvement in profitability. Profits after tax rose by 35.4% to KES 668.5 million from KES 493.5 million due to an ongoing implementation of its diversification policy and strategy that has seen it extend its marketing and sales efforts to non-traditional markets. As a result, overall sales rose to KES 6.8 billion from KES 5.34 billion in 2012 while operational incomes jumped by 26% to KES 1.47 billion from KES 1.2 billion recorded in the previous year.

TPS Eastern Africa Limited posted its group results for the year ending 31st December 2013 which showed a remarkable improvement in profitability. Profits after tax rose by 35.4% to KES 668.5 million from KES 493.5 million due to an ongoing implementation of its diversification policy and strategy that has seen it extend its marketing and sales efforts to non-traditional markets. As a result, overall sales rose to KES 6.8 billion from KES 5.34 billion in 2012 while operational incomes jumped by 26% to KES 1.47 billion from KES 1.2 billion recorded in the previous year.

The impressive performance easily displays the company’s resilience as it has achieved all this on the background of falling tourists’ arrivals into the country. According to Kenya National Bureau of statistics (KNBS) tourist arrivals dropped to 1.1 million from 1.24 million in 2012 making it the third year in a row that these numbers are recording a drop. In addition, the March 4th general election coupled with the terrorist attack at the Westgate Mall later in that year all made the operating environment tough to navigate.

Investors appear to have priced in a losing year (2013) if its share price performance is anything to go by. The stock is trading down 22.2% year to date at KES 41. It remains to be seen whether the surprise positive earnings will bring a change in its downward trend. That said, perhaps what investors should consider going forward is whether the same performance can be repeated given same or even a worse operating environment. Below is a brief S.W.O.T. analysis of the business which investors can use as a guideline to this effect.

Strengths

- Regional presence -Serena Tanzania and Uganda posted good performances last year boosting the company’s overall performance.

- Renowned brand.

- Diversified product offering.

- Continued integration of the group’s regional businesses and acquisitions as well as Greenfield investments poised to improve operational efficiencies.

- Expansive city hotel circuit-city hotels tend to be more immune to the seasonality inherent in the sector.

Weaknesses

- High operational expenses.

- Slim profit margins.

- Reliance on commission based travel agents as opposed to online bookings. The later can significantly reduce its expense burden and improve its margins. Agents accounts for 95% of bookings for its lodges, 65% for its coastal hotels and 20% for its city hotels.

Opportunities

- Emerging new source markets like Middle East, India, China, Russia and Brazil.

- Emerging middle-incomers in the country spurring domestic tourism. The number of Kenyans who visited various tourist destinations in the country increased from 31% to 41%.

- Conference tourism - growth in this segment has seen Kenya’s global ranking in conferencing rise four ranks and emerge the second best destination in Africa.

- Increase in international arrivals - the government targets 75% increase in arrivals to 3 million tourists by 2015.

- Single East Africa Visa.

Threats

- Value Added tax of 16% on tourism services in Kenya including park entrance fees.

- Increased poaching in the country eroding the country’s brand equity.

- Frequent travel advisories by United States and the United Kingdom, the traditional major tourism source markets, will continue to pose a challenge to the speedy recovery of the sector.

- Competition for the business traveller and conference facilities has intensified following the entry of international hotel chains such as Radison, Crown Plaza, Kempinski and Bell Wester.

- Slow recovery of the major European economies.

- Volatility in the local currency.

My honest evaluation is that TPS Serena is still an attractive stock but as long term play. Short term-mid-term investors may not withstand its short term volatility. The stock has steadily declined in the past three years by as much as 37.5% from a high of KES 68 recorded early in 2011. Year to date, the stock is down 5.5%. The hospitality stock trades below a bearish exponential moving averages making it least attractive even for short term bets. Again, investors betting in the recovery of the tourism sector but with a longer term perspective may participate in the stock.