Interest Rates

Our previous month’s newsletter focused on the interest rate scenario and forecast an imminent change in the direction of Monetary Policy. On 22nd March, the Monetary Policy Committee of the Central Bank announced a shift in its monetary policy stance by increasing the Central Bank Rate (CBR) from 5.75% to 6.00%. This was the first increase in the CBR since June 2007 and followed a series of 8 cuts in the rate between December 2008 and January 2011.

In order to give effect to its changed monetary policy stance, the Central Bank also resumed Repo transactions as part of its Open Market Operations after a gap of almost two years. As discussed in detail in our previous paper, Open Market Operations have a more direct impact on market rates and market expectations than changes in the CBR, and would have the effect of putting a floor on short term rates in the market. We expect the Central Bank to regularly carry out repo transactions as part of its Open Market Operations in the next few months.

The yield on the 91-day Treasury bill has risen from 2.36% in December 2010 to 2.91% at the last auction, and we expect this to accelerate towards our target of 5.00%.

Yields on Treasury bonds have similarly been rising sharply, with the 5 year Treasury bond which was issued in January 2011 at an average yield of 7.64% being re-issued in March at a yield of 8.50%, an increase of 86 basis points in two months. Similarly the 30 year Treasury bond which was issued in February 2011 at an average yield of 12.99% was re-issued in March at a yield of 13.52%. These sharp increases in yields will result in severe mark to market losses in trading portfolios of banks and other investors. Unfortunately, the prices and yields reported by the NSE have long ceased to have any credibility, and a majority of the trades reported at the NSE are at artificial prices. This poses the very real danger of bond losses being pushed to less savvy investors by unscrupulous market players.

Secondary Market Trading Outlook

2010 was the golden year for trading in the bond markets in Kenya, with the sharp drop in market interest rates. With interest rates on the rise, investors will witness mark to market losses on their holdings. We believe the period of rising interest rates will give investors the opportunity to acquire bonds at attractive yields, earn interest carry, and then look for trading opportunities when the interest rate cycle peaks. This will require patience and discretion in picking the right maturities with acceptable risk.

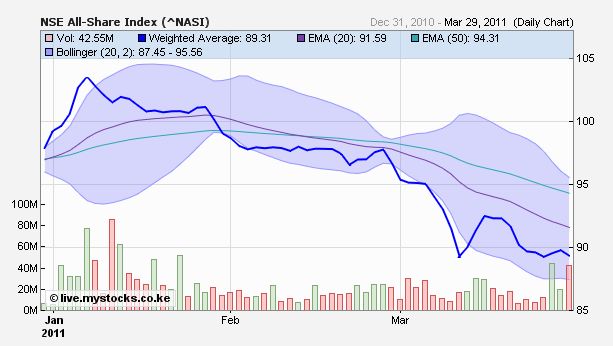

Equity Markets

The equity market rose smartly for the first week of 2011, but has been on a slide since then. The optimism at the beginning of the year has been replaced by a sense of gloom, with a number of stocks at or near their 12 month lows. Very positive earnings reported by a number of listed companies have done little to lift the share prices.

We are cautiously bullish on a few counters in the Industrial Sector which have lagged the market despite having produced good results for 2010 and having attractive prospects for the current year. We are more cautious on the Financial Services sector, as most of the listed banks and insurance companies will struggle to match their 2010 results which were driven by better interest spreads as well as bond trading profits for banks, and by investment returns for insurance companies. Both these factors are unlikely to be repeated in 2011.

Our selected stock pick for this month is an unusual choice. Firstly, it is from the financial services sector, which we believe does not have a very positive outlook this month. More interestingly, it is an unlisted stock. Our analysis is on the following page.