The Monetary Policy Committee (MPC) held a special meeting on 14th September 2011. The meeting had become necessary as the previous actions of the MPC this year had been largely ineffective, and the Central Bank of Kenya (CBK) had been forced to take a number of measures between the MPC meetings in order to stabilize markets.

The key pronouncements by the MPC at the meeting were:

- The Committee strongly reiterated its overriding objective to fight inflation and to bring it down to target levels. The inflation objective will be pursued through a gradual tightening of monetary conditions.

- Monetary tightening will be implemented by adhering to quarterly Net Domestic Asset (NDA) targets as agreed under the Extended Credit Facility (ECF) supported program with the International Monetary Fund (IMF).

- If the NDA is above target, policy rate will be raised and vice versa.

- MPC to explicitly show the precise way in which CBR is the policy rate governing the levels of other rates – repo and reverse repo operations to be conducted with rates that will be clearly defined with respect to the CBR.

- Pressure on balance of payments to be eased by further financial support from the IMF. Additional foreign exchange flows targeted from infrastructure bond as well as from possible sovereign bond issue.

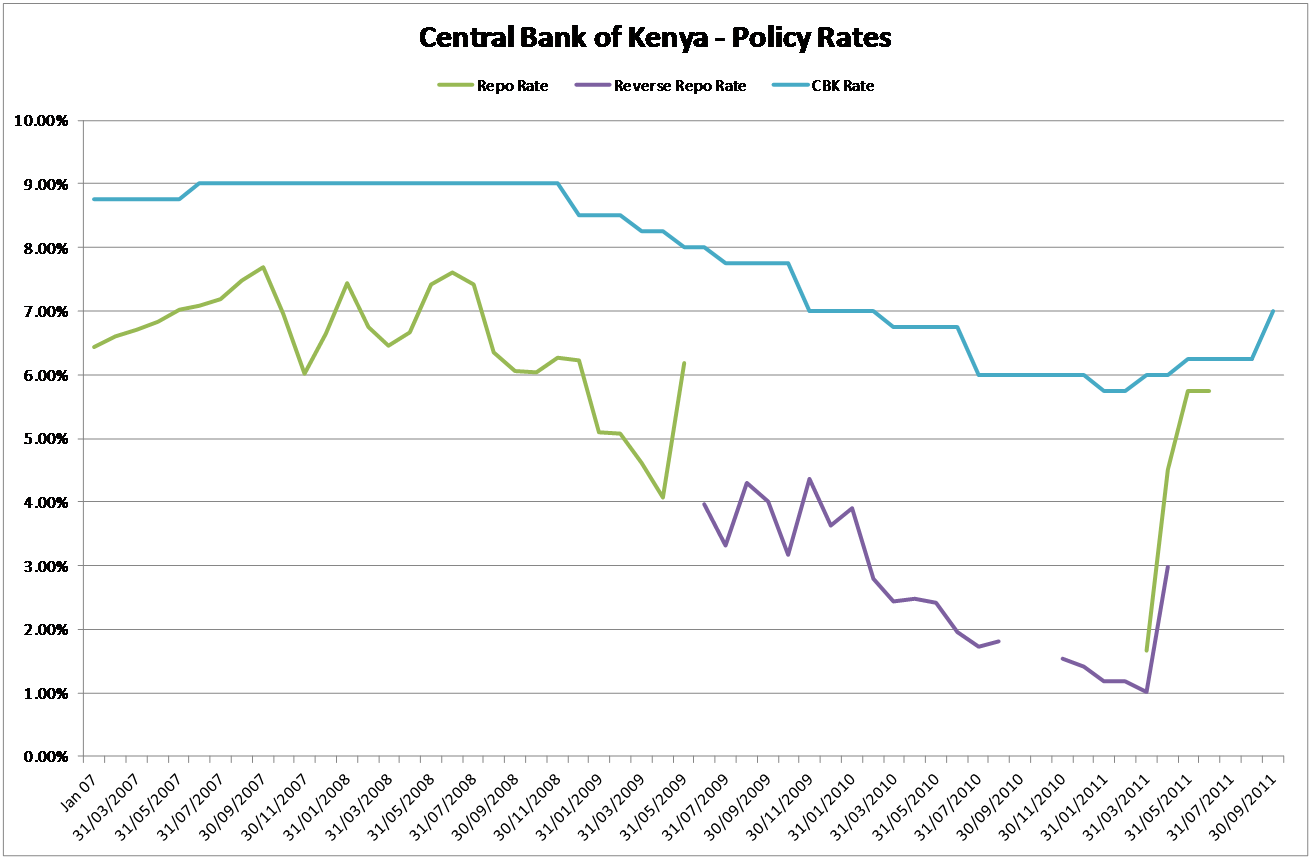

- Central Bank Rate (CBR) revised from 6.25% to 7.00%.

The clarification that the principal objective of Monetary Policy is to rein in inflation and inflationary expectations is very welcome, as this removes the confusion that the objective of monetary policy is to promote growth. Whereas this may have been an immediate objective following economic conditions witnessed in 2009, this cannot be the continuing objective of monetary policy. Articles in the popular press and also by some analysts calling for lowering of rates by the Central Bank in response to inflation add to the level of confusion in the market.

The confusion in the policy response is cleared admirably in a discussion paper available on CBK’s web-site. We have provided relevant extracts from this paper in Annexure 1.

The revision in the CBR was the third increase in the rate this year, and follows a series of 8 cuts in the rate during the period December 2008 to January 2011.

One of the key reasons for the volatility in interest rates and also in the exchange rate this year has been the perceived lack of consistency in the monetary policy being followed by the MPC. In order to reinforce the credibility of the policy, the MPC and the CBK need to address the following specific issues:

- The inflation objective needs to be clearly spelt out by the MPC, which should also specify whether the inflation target is for Core inflation or for Headline inflation. The target then needs to be followed consistently.

- The monetary policy has shifted this year from targeting Reserve Money to targeting Broad Money and now to targeting Net Domestic Assets (NDA). However what has not been specified by the MPC or indeed in any CBK publication are the targets for NDA. This needs to be clearly enunciated by the CBK, and the performance of actual NDA against the target needs to be regularly reported.

- The intent to provide explicit linkage of CBR to other rates of the CBK is very welcome, and needs to be elaborated at the soonest. As can be seen in the chart above, the Repo and Reverse Repo operations have in the past been carried out without any clear linkage to the CBR. The extremely low rates at which Reverse Repos have been carried out in the past (at times more than 450 basis points below CBR) is undoubtedly one of the factors leading to the volatility in rates and the depreciation of the Shilling in 2011.