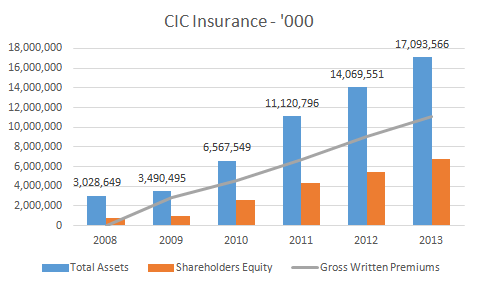

CIC Insurance released its 2013 year end results which registered a marginal rise in profitability. Profits before tax stood at KES 1.67 billion, up 1.3% from KES 1.64 billion in 2012 due to increase in claims incurred and operating expenses. Aggressive growth strategies has seen the insurer grow its gross written premiums by an annual compounded growth of 30.9% in the last five years. Gross written premiums stood at KES 11 billion as at the end of 2013. On the other hand, claims have also grown by a similar margin increased underwriting risk.

The firm has managed to consistently keep its operational expenses below 30% against its total income for a considerable length of time which is commendable. As a result, profitability has grown 40% Y-o-Y in the past six years demonstrating managements’ abilities to create value for its shareholders. Return on assets has averaged at 8.8% since 2008 which is acceptable considering its low risk investment strategies. Return on equity averaged an impressive 26% in the same period. Debt ratios improved to 60.5% last year, down from 61.1% in the previous year as interest rates fell down in the reporting period. Total assets stand at KES 17 billion. Overall, fundamentals appear to be in good position.

Plans to sustain its growth momentum through focusing on regional expansion are laudable simply because insurance penetration in the country remains remarkably low. In the last five years, it has stagnated at an average of 2.5%. Of this, general insurance as a proportion of national income stood at 1.8% in 2007 while long term insurance recorded a mere 0.7%. Therefore, with more than 40 insurance firms in the country battling for a piece of the KES 47 billion-a-year premium cake, it is wise to diversify regionally.

Plans to sustain its growth momentum through focusing on regional expansion are laudable simply because insurance penetration in the country remains remarkably low. In the last five years, it has stagnated at an average of 2.5%. Of this, general insurance as a proportion of national income stood at 1.8% in 2007 while long term insurance recorded a mere 0.7%. Therefore, with more than 40 insurance firms in the country battling for a piece of the KES 47 billion-a-year premium cake, it is wise to diversify regionally.

Our high risk standing as a country is also a major concern based on the growth of the industry. Kenya’s political, economic and financial system risk is considered to be very high according to A.M. Best, a global rating company that provides data and research on insurance companies. Kenya’s is ranked at CRT (Country Risk Tier-5) due to weak regulatory structure. Countries with CRT-5 are considered risky and therefore pose a great challenge to an insurer’s financial stability, strength and performance. Such an evaluation at least gives a simple reason why our premiums are set high and so consequently stifles industry growth.

Recent consolidation in the industry-British American Insurance Group’s acquisition of Real Insurance and ICEA Insurance merger with Lion Kenya, is likely to set a trend going forward forcing industry players to follow the same route or go after additional capital. CIC has chosen to retain its cash via a bonus issue in the interim but it is likely to raise additional capital to support its expansion strategy. Additionally, forays into the micro insurance space and the development of new channels of distribution such as partnership with Tuskys and banks through bancassurance are sure to fend off competition. This coupled with the strong financial standing and backing by its anchor shareholder - Cooperative Bank , it’s only a matter of time before it emerges to command a leading in the industry. The stock is currently trading at KES 7.15, up an amazing 23.2% year-to-date. Investors need take a look at this growth stock. ‘