Nairobi Securities Exchange Stock Picks - March 2014

By Cannon Asset Managers

(Cannon Asset Managers)

Tuesday, March 25, 2014 at 8:29 AM EAT

Summary

| Sector | Stocks | Current Price |

| Banking | CFC Stanbic | 107.00 |

| Investments | Centum Investments | 37.25 |

| Insurance | Britam | 18.50 |

| Energy | Kenol | 9.55 |

CFC Stanbic Bank

Investment Consideration:

- Consolidation after the merger.

- 70% rise in PAT FY2013

- Attractive valuation compared to its peer. Price to book of 1.3, sector P/B 2.2

Centum Investment

Investment Consideration:

- Real Estate play - Uganda and Runda development

- Rea Vipingo offer - 10,000 acres in Kenyan coast

- Strong major shareholders- to increase share holding from 24 to 29%

- Recent acquisition of second largest Kenya Asset Manager

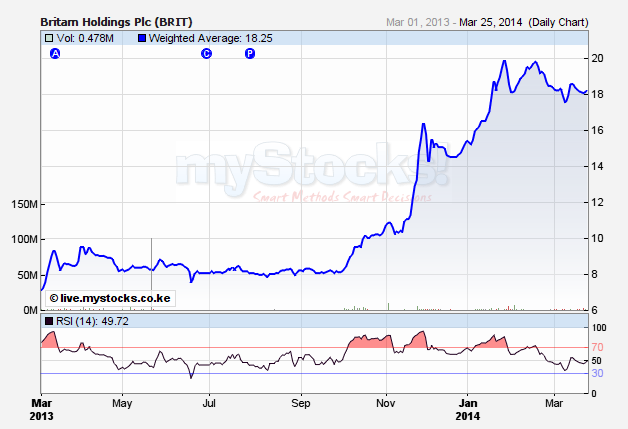

British American Investment Company- Britam

Investment Consideration:

- Recent acquisitions of Real Insurance resulting to Britam becoming the 2nd largest General Insurance Company and the largest Ordinary Life Insurance Company in Kenya.

- Acquisition of 25% stake in Acorn Group, a renowned property development firm will boost the company’s property business strategy.

- Launch of new products which have become favourite with the market- Linda Jamii

Kenol Kobil

Investment Consideration:

- KenolKobil has the largest overall market share (including exports). The company operates in 8 African countries giving it a wider coverage compared to other local players.

- Recovery from a loss in 2012. Half year results in 2013 reported return to profitability.

- Remains a target for take over for any petroleum company looking for a stake in East and Central Africa

Comments

comments powered by